Hedge with an edge

Turn uncertainty into opportunity with C8 Hedge

Gain the edge you need in a systematic way

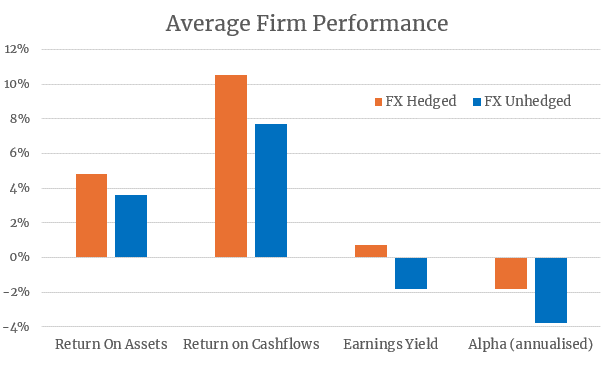

A company has currency exposure whenever they buy or sell a product overseas or buy or sell an overseas asset. Managing FX risk has been shown to improve corporate performance: firms that hedge tend to outperform their unhedged peers.

Turn uncertainty into opportunity with C8 Hedge

- Calculate optimal FX hedge ratios for all your currency exposures, both assets and liabilities

- Set target hedge ratios and permitted variation

- Set turnover constraints including minimum hedge ratio change

- Add risk weights for each currency exposure, configured to use either option or realised volatility

- Calculate individual optimal FX hedge ratios within an overall portfolio risk limit

- Use your existing FX execution implementation, or with light touch integration

- Keep full control of all FX hedging

The C8 Hedge Team

C8 Hedge is managed by Jon Webb, who has been involved in FX since 1985, first as a HM Treasury then City economist, followed by a long career as a bank and hedge fund proprietary trader. Finally, as the Global Head of FX Strategy at Jefferies investment bank.

The founding partners of C8, Mattias Eriksson and Ebrahim Kasenally worked with Jon Webb at HSBC London in 1990’s before becoming partners at Bluecrest Capital Management, building Bluetrend into a $15bio systematic fund, with an important FX component.

Gain the edge you need in a systematic way

The C8 team has decades of experience in currency markets at both major banks and funds.

C8 has a deep understanding of FX markets and modelling currency drivers as well as the intricate risks that multinational companies and funds face.

Harness the power of machine learning (ML) as C8 identifies patterns in historical data that are predictors of future currency movements.

In conjunction with ML, C8 delves into the relationships between currencies and macro-economic factors, providing a comprehensive analysis of currency drivers.

No one-size-fits-all – use C8 Hedge to craft customized FX hedging solutions that align precisely with your unique needs.

C8Hedge doesn't just react; it predicts. Our solution identifies potential exposures and offers proactive strategies to optimise financial outcomes.

No more ad-hoc decisions. C8Hedge enforces a disciplined approach, aligning with your financial objectives while adhering to best practices in risk management.

Say goodbye to manual calculations and guesswork. C8Hedge automates the FX risk management process, allowing your team to focus on higher-value tasks.

C8 has its offices in key locations

17 Hanover Square

London

W1S 1BN

477 Madison Avenue

New York,

NY10022

Rooms 1101A-4

China Evergrande Centre

38 Gloucester Road

HK

Room 3AN204F

Kerry Parkside

1155 FangDian Road

Pudong District

China

Lee View House

13 South Terrace

Cork

Ireland

Via Olona 12

20123 Milan

Italy

Calle Santiago Rusiñol 13

Atico 7

28040 Madrid

Spain

C8 is a fintech company that believes in empowering its clients through technology, giving users the freedom to choose, combine and trade strategies sourced from its platform.

C8 Technologies was established in 2017 in London by Mattias Eriksson and Ebrahim Kasenally, previously partners and senior executives at BlueCrest Capital Management - one of the largest global alternative investment management firms. C8 combines decades of investment research with experience in innovative trading technology.

Follow the link for more information: c8-technologies.com