“Once again… we’ve had a year-end projection for inflation… kind of fallen apart”

Ah! The start of the new year. The new calendar offers so much possibility! A moment of change that seems to come just as we have spent time following traditions and celebrating holidays that have managed to survive. It’s a comforting reminder that while “progress” is relentless, amid the seasonal ebb and flow there are still some things we can rely on. A missed Fed inflation and rates projection, a TFTD that is once again arriving after the end of the year (mea culpa encore), and… a return to the wisdom of Whitney Houston?

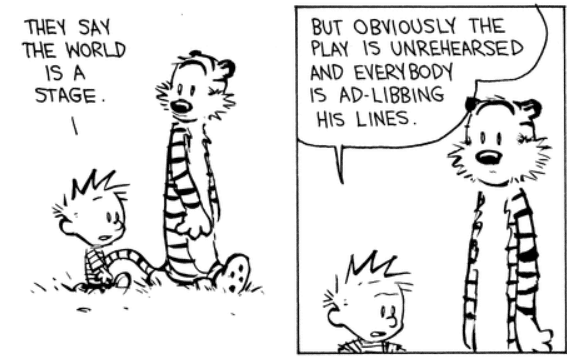

Of course, we kid (somewhat), though for younger readers “crack is whack”, but just as we noted in our opening newsletter from last year, we are again thinking about the perennial meta question – “How will I know?”. Sure, we may have meandered into legal theory (“cui bono” and wondering “why now?”) last year. But one of the prevailing themes was precisely what Mrs. Houston was pondering: How can we (both the macro and micro we) know what is going on in the economy? This year, Powell and friends continued to argue that we know the effects of interest rate hikes by their works, but they argued (and stuck to their guns) that rates were restrictive in the face of (relatively) loose financial conditions. And when trying to determine how the Fed members develop their forecasts, the chair admitted that there is a “yes, no, maybe, all of the above” approach to integrating potential future policy moves into projections? What’s a girl to believe?

Further, we were encouraged not to believe our own eyes. The likes of Adam Tooze argued that laymen should ignore what they see and feel about the economy and leave it to the experts (yes, the guys from Team Transitory). Such a line of argument might have been a mistake given it was an election year, but there’s no way to run an experiment to check the counterfactual, so hey, why not give it a shot.

And if all of that weren’t enough… the data itself didn’t provide much of a leg to stand on. While some of the inconsistencies and discrepancies certainly have good reasons/justifications behind them (people hit by hurricanes have better things to be doing than responding to surveys), the “quite interesting” revisions to GDI, for example, lead to a massive shift in the understanding of, and narrative around, the health of the consumer, who, by the way, is responsible for a healthy portion of the US economy. It would seem that that would be something to have a good handle on. But alas…

Anyway, rather than tilting at windmills and fussing about the inherent trickiness of discerning the direction of the economic data winds, we want to take a moment to thank all of you for reading, interacting, and sharing with us. We look forward to and wish you all a very prosperous 2025.